Home Loan

A home loan turns dreams into reality, helping you own the space where your heart truly belongs your dream home.

Home Loan: Everything You Need to Know About Home Loan at Minimum Interest Rate

Buying a home is one of the biggest financial decisions in a person’s life. For most people it is not possible to purchase a home outright with savings. This is where a home loan becomes crucial. It enables you to buy your dream home while repaying the amount over time. However, getting a home loan at minimum interest rate is just as important as choosing the right property.

In this guide, we will cover everything you need to know about home loans especially if you are a salaried individual. Whether you're a first-time buyer or planning to upgrade to a better house, this comprehensive guide will help you make smart and informed choices.

What is a Home Loan?

A home loan is a secured loan provided by financial institutions like banks or housing finance companies (HFCs) to help individuals buy, build, or renovate residential property. The borrower repays the loan amount with interest through monthly installments known as EMIs (Equated Monthly Installments).

For salaried individuals, home loans are relatively easy to avail because lenders consider salaried income as a stable source of repayment. That’s why most banks offer home loan for salaried people with attractive terms.

Types of Home Loans

Before applying, it's essential to know the different types of home loans available in India:

- Home Purchase Loan – The most common type used to purchase a new or resale home.

- Home Construction Loan – For building a home on a plot of land you own.

- Home Renovation Loan – For repairing, remodeling, or upgrading your existing house.

- Home Extension Loan – For expanding your home, such as adding a room or a floor.

- Balance Transfer Loan – Allows you to transfer your existing loan to another lender offering a home loan at minimum interest rate.

Why Choose a Home Loan for Salaried?

A home loan for salaried individuals comes with several advantages:

- Quick Processing: With stable monthly income, banks process loans faster for salaried professionals.

- Attractive Interest Rates: Salaried borrowers often get a home loan at minimum interest rate compared to self-employed applicants.

- Flexible Repayment: Tenures range from 10 to 30 years, helping to keep EMIs manageable.

- High Loan Eligibility: Based on your income, age, and credit score, you may qualify for a higher loan amount.

- Tax Benefits: Under Sections 80C and 24(b) of the Income Tax Act, you can claim deductions on principal and interest payments.

Factors Affecting Home Loan Eligibility

To get a home loan at minimum interest rate, you need to understand what influences your eligibility and loan terms:

- Income Level – Banks prefer salaried individuals with a steady job and income. Higher salary = higher loan eligibility.

- Credit Score – A good credit score (750 and above) improves your chances of loan approval and helps you get a home loan at minimum interest rate.

- Employer Profile – Working for a reputed private company, MNC, or government organization is a big plus.

- Age – Most lenders offer home loans for salaried people aged between 21 and 60 years.

- Existing Debts – Too many EMIs already₹ It could reduce your eligibility or raise the interest rate.

How to Get a Home Loan at Minimum Interest Rate?

Securing a home loan at minimum interest rate requires careful planning and comparison. Here’s how to improve your chances:

- Compare Lenders – Don’t go with the first bank that offers you a loan. Compare interest rates, processing fees, and hidden charges from multiple lenders.

- Improve Your Credit Score – A score above 750 gets you better offers. Pay your credit card bills and EMIs on time.

- Choose a Shorter Tenure – While longer tenures reduce EMI, shorter tenures often come with lower interest rates.

- Apply Online – Many banks offer discounts on processing fees and lower rates for online applications.

- Go for a Balance Transfer – Already have a loan₹ Shift to a lender offering a home loan at minimum interest rate to save on interest.

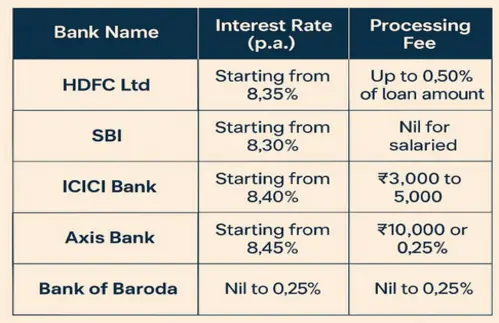

Best Banks Offering Home Loan for Salaried with Minimum Interest Rate (As of 2025)

| Bank Name | Interest Rate (p.a.) | Processing Fee |

|---|---|---|

| HDFC Ltd | Starting from 8.35% | Up to 0.50% of loan amount |

| SBI | Starting from 8.30% | Nil for salaried |

| ICICI Bank | Starting from 8.40% | ₹3,000 to ₹5,000 |

| Axis Bank | Starting from 8.45% | ₹10,000 or 0.25% |

| Bank of Baroda | Starting from 8.35% | Nil to 0.25% |

Documentation for Home Loan for Salaried Individuals

Here’s the list of commonly required documents:

- ID Proof – PAN card, Aadhaar card, Passport

- Address Proof – Utility bill, Voter ID, Rent agreement

- Income Proof – Salary slips (last 3 months), Form 16, bank statements (6 months)

- Employment Proof – Employment certificate, appointment letter

- Property Documents – Agreement to sale, property tax receipts, NOC

EMI Calculator – Know Before You Borrow

Before applying for a home loan, use an online EMI calculator. It helps you:

- Understand your monthly outflow

- Compare different interest rates

- Choose the right tenure

- Plan your finances better

For example, a loan of ₹40 lakhs at 8.5% interest for 20 years will result in an EMI of approximately ₹34,676.

Things to Consider Before Taking a Home Loan

- Interest Type: Fixed vs Floating. Floating rates may offer a home loan at minimum interest rate in the long term.

- Prepayment Charges: Choose lenders with zero or minimal prepayment penalties.

- Processing Fee: A high fee can add to your overall cost.

- Customer Service: Choose a lender known for transparency and service.

- Loan Insurance: Consider opting for loan insurance in case of unforeseen events.

Tips to Repay Your Home Loan Faster

- Make part-prepayments whenever possible

- Increase your EMI with every salary hike

- Use annual bonuses to reduce principal

- Choose a lower tenure if manageable

Paying off your home loan early saves a significant amount on interest and gives you peace of mind.

Tax Benefits on Home Loans

Salaried borrowers can enjoy significant tax savings:

- Section 80C: Up to ₹1.5 lakhs on principal repayment

- Section 24(b): Up to ₹2 lakhs on interest repayment

- Section 80EE/80EEA: Additional benefits for first-time homebuyers

Final Thoughts

A home loan is more than just a financial product—it's a bridge to your dream home. For salaried individuals, getting a home loan at minimum interest rate can ease the repayment burden and make homeownership more affordable. Whether you're just starting your homeownership journey or thinking about refinancing, always stay informed and compare all your options.

At the end of the day, a well-planned home loan for salaried individuals can unlock new doors literally and financially.